Metals in electric car production

In July 2017, Nornickel signed a memorandum with BASF and began negotiations on a project to increase sales to manufacturers of batteries for electric vehicles.

![Владимир Потанин]()

This is a pilot project. If it is successful, we can launch commercial production by 2020.”

“Today, markets are taking a new look at our products. The demand for palladium is growing. Cobalt and nickel are also benefitting from a positive trend supported by the production of batteries for electric vehicles. Accordingly, we are considering ways to increase shareholder value by adjusting our product portfolio to the requirements of new industries and new demand. We see current market expectations as somewhat inflated and do not commit ourselves to large-scale investments. Still, we are trying to be proactive in our marketing policy and proceed with what we call fine-tuning of our product lines. ”

“We are an industrial company, not a venture one. For us, a responsible decision is to invest in successful technologies only.”

Vladimir Potanin President of Nornickel

For the Company, this project is an opportunity to carve a niche in the attractive and rapidly growing market for rechargeable battery materials. Cooperation with BASF is part of Nornickel’s strategy to develop environmentally-friendly technologies and make an active contribution towards improving the environment globally. Today, the Company provides manufacturers of automotive catalysts with essential chemicals capable of capturing dangerous exhaust fumes generated by petrol engines. By expanding the supply of metals for the automotive industry with its strong potential, the Company makes another step towards sustainable development.

Key trend in the global automotive industry

The electric vehicle industry is clearly facing a period of intensive growth, which will boost long-term demand for key metals. However, so far experts have not come to a consensus on market growth projections. Sales forecasts for electric and hybrid cars vary from 2 mln cars to 11 mln cars per year by 2025.

Market outlook for 2035 is much more optimistic. BP projects the total number of EV and hybrids to grow to at least 100 mln globally. According to analysts from Carbon Tracker Initiative and Imperial College London, electric vehicles are expected to account for one third of the automotive market by 2035 and for more than a half by 2040. One of the most likely drivers of EV expansion will be government policy in many developed countries committed to introducing a broad range of incentives to promote the production of green cars, up to imposing an ultimate ban on the sale of cars with internal combustion engines. Still, this is unlikely to happen before 2025.

Nornickel’s position

Over a short-term horizon, the Company is not planning any investments in large-scale production of materials for the electric vehicle industry, as the EV technology is still in the development phase. However, the Company is prepared to reconsider its position should the trend change.

Nornickel expects demand for nickel from manufacturers of rechargeable batteries for EV production to increase dramatically in the mid-term, but this will not be the case before 2020, when the automotive industry is ready to shift to electric vehicles. By 2025, the Company forecasts the demand for nickel in the EV market to grow to 420 kt from the current 43 kt, in addition to demand from stainless steel manufacturers, historically the largest consumers of nickel. In the mid-term, the key trend in the EV market will also be the production of hybrid vehicles that rely on both an internal combustion engine (ICE) and an electric engine. Per unit PGM consumption in hybrid cars is higher than in traditional vehicles with the same ICE volume; accordingly, we expect palladium consumption to increase by 3 mln oz by 2025.

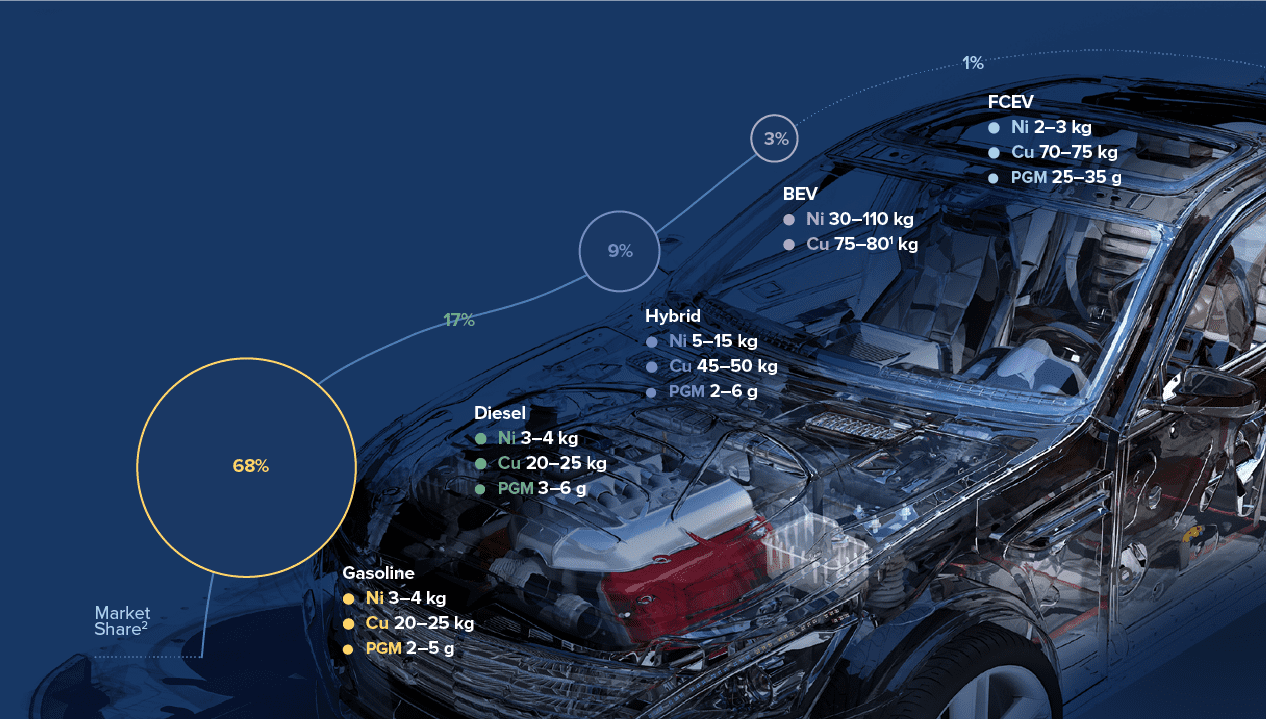

Use of Nornickel metals in electric vehicle manufacturing

Source: Company estimates, LMC Automotive, Bloomberg.

As compared to petrol and diesel engines, the consumption of metals produced by Nornickel in the manufacturing of EV engines is much more intensive. The process requires 2 to 27 times more of nickel, 2 to 4 times more of copper, and 12 to 17 times more of PGM (the latter are particularly important for fuel cell vehicles).